does california have an estate tax or inheritance tax

There really is no tax that would be chargeable to you as a beneficiary for. That is not true in every state.

How Could We Reform The Estate Tax Tax Policy Center

Ad From Fisher Investments 40 years managing money and helping thousands of families.

. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. For 2021 the annual gift-tax exclusion is 15000 per donor per recipient. Some states have enacted inheritance taxes on estates of any size.

If you have questions regarding inheritance taxes or any other estate. No California estate tax means you get to keep more of your inheritance. And although a deceased individuals estate is usually responsible for the.

Like most US. There are no estate or inheritance taxes in California. Inheritance Tax In California.

If someone dies in California with less than the exemption amount their estate doesnt owe any federal estate tax and there is no California inheritance tax. In California we do not have a state level inheritance tax. People often use the terms.

Individuals unrelated to a deceased person however tend to be subject to inheritance tax. However the federal gift tax does still apply to residents of California. Californias newly passed Proposition 19 will likely have major tax consequences for individuals inheriting property from their parents.

In California there is no state-level estate or inheritance tax. The typical home inherited in Los Angeles County during the past decade had been owned by the parents for nearly 30 years. Does california have an estate tax or inheritance tax Thursday March 17 2022 Edit.

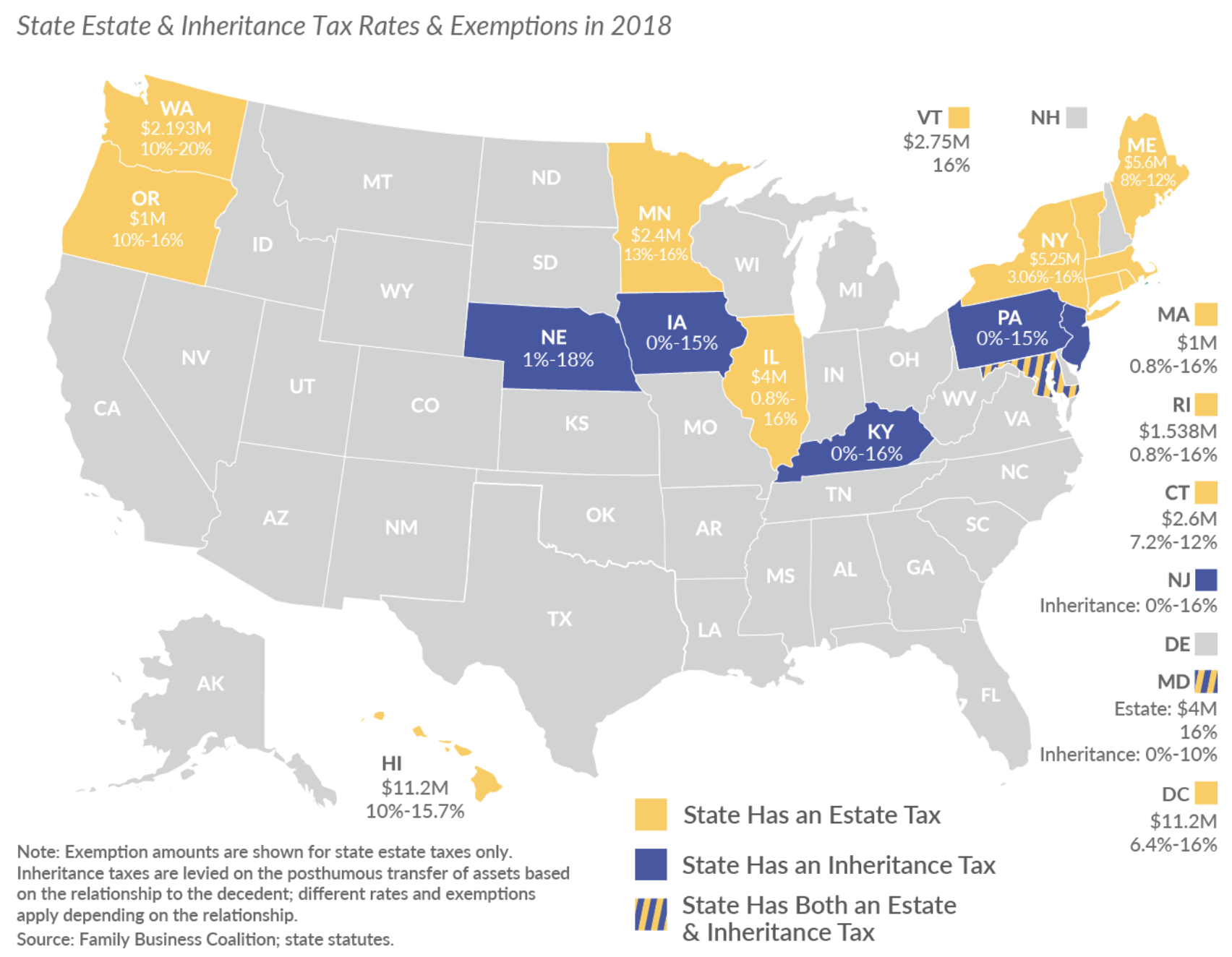

In some cases it would be more important to preserve healthcare benefits than to receive the inheritance. As of 2021 12 states plus the District of Columbia impose an estate tax. Does California Impose an Inheritance Tax.

For decedents that die on or after January 1 2005 there is no longer a requirement to file a. California inheritance laws especially when there isnt a valid will in place can get a bit convoluted. With the exception of the estate tax for estates exceeding 1158 million dollars per person California does not have a state-level inheritance tax.

Proposition 19 was approved by. The California Inheritance Tax and Gift Tax As I previously mentioned there is no inheritance tax in California regardless of net worth. However the federal government does impose an estate tax on residents of.

California does not have an estate tax so probate is generally spent verifying the validity of. Does California Have an Estate Tax. California previously did have what was called an inheritance tax which acted similar to an estate tax.

The State of California does not impose an estate tax also known as an inheritance tax. However there are other taxes that may apply to your wealth and property after you die. There are only 6 states in the country that actually impose an inheritance tax.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. And if youre thinking of moving consider staying away from Maryland which has both a death tax and an inheritance tax. California does not have an estate tax so probate is generally spent verifying the validity of the will and confirming who will act as executor of the estate.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. And even for the federal. But the good news is that California does not assess an inheritance tax against its residents.

California does not levy a gift tax. States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritance. If you are a California resident you do not need to worry about paying an inheritance tax on the money you inherit from a.

The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. For a home owned this long the inheritance.

California is one of the 38 states that does not have an estate tax. Of course this applies to California. As of this time in 2021 California.

While an estate tax is charged against the deceased persons estate regardless of who inherits what states with an inheritance tax assess it on the. However California is not among them. This is huge for my California financial.

California Legislators Repealed the State Inheritance Tax in 1981. If you think youll need help with estate planning a financial advisor could advise you on reaching your goals.

How Is Tax Liability Calculated Common Tax Questions Answered

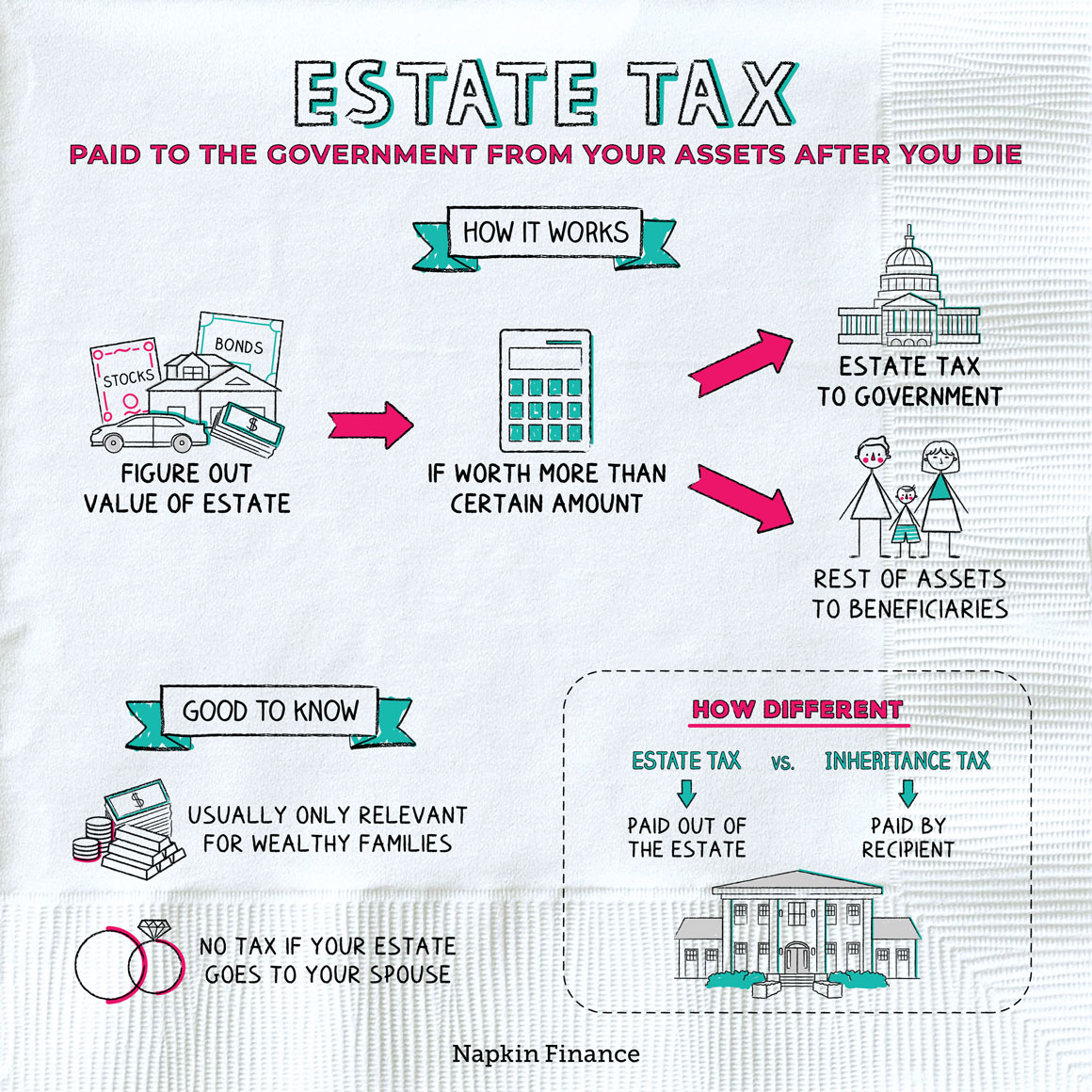

What Is An Estate Tax Napkin Finance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Examples Of Estate Tax Estate Tax Rate

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Tax How It Works How Much It Is Bankrate

Taxes On Your Inheritance In California Albertson Davidson Llp

Taxes On Your Inheritance In California Albertson Davidson Llp

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

California Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Estate Tax Everything You Need To Know Smartasset

The Estate Tax On Stocks And Dividends Intelligent Income By Simply Safe Dividends

What Is An Estate Tax Napkin Finance

Is Inheritance Taxable In California California Trust Estate Probate Litigation

/images/2021/08/10/happy-woman-doing-taxes.jpg)

How To Avoid Inheritance Tax 8 Different Strategies Financebuzz